STOCK MARKET PART 7

Stock Market Test

40 Questions

NAME :

DATE :

1. What are the two general types of stocks? CHOOSE TWO

A Deferred B Common

C Preferred D Certificate of Deposit

2. An index that measures the average health of 30 large, publicly owned, US companies is called the...?

A Guess Again Index B The S&P 500

C Bob Johnson's Index D Dow Jones Industrial Average (DJIA)

3. Which of the following best describes diversification?

A putting all your investments in two

financial investments

B reducing risk by investing in different

types of securities

C investing in different types of bonds

D Avoiding risk by investing in blue-chip

stocks

4. Not all companies offer dividends.

A false B true

5. The two major stock exchanges are

A Dow Jones Industrial Average & S&P 500 B NASDAQ & DJIA

C NASDAQ & NYSE D NYSE & American

6.

What is a stock market crash?

A when one or two stocks drop signifiicantly B rapid but anticipated drop in stock prices

C rapid and unanticipated drop in stock

prices

D slow decrease in stock prices over a year

7. The DOW Jones Industrial Average is an index of 30 American companies. Why is the DOW Jones Industrial Average important?

A It provides a snapshot of how the stock

market and the US economy is doing.

B It tells Americans how many jobs are out

there.

C It tells Americans how much debt the

country is in.

D It helps economists predict when a stock

market crash will happen.

8. What is the stock market?

A

A type of bank that gives out loans to new

businesses.

B

A special type of grocery store that sells

stocks.

C

A type of farmers market where people

buy and sell food.

D

A place where parts of businesses are

bought and sold.

9. The group of stocks that you own is called a

A portfolio B commission

C dividend

10.

A sum of money paid to shareholders of a corporation out of its

earnings.

A index B invest

C dividend D profit

11. If a business wants to raise capital but not create debt, it can

A float a bond issue B issue common stock

C borrow money from a commercial bank D borrow money from the government

12. IPO stands for

A Itemized Public Organization B Initial Public Offering

C Imminent Profitable Option D Initial Primary Offering

13. The Dow Jones Industrial Average is an example of

A A Stock Market Performance Index B a Stock Market Exchange

C a Brokerage Firm D a Mutual Fund

14. A time when stock prices are RISING is called

A bull market B transaction

C bear market

15. The NYSE and NASDAQ are forms of ________________ where people trade stocks.

A businesses B mutual funds

C stock exchanges D large shopping centers

16.

A group of large companies that stockbrokers look at to gauge how

the market is doing as a whole.

A industry B shareholder

C portfolio D index

17. The current price of one share of stock is called

A Ask B Bid

C Last D Open

18. Which of the following is NOT a stock index?

A P/E RATIO B DOW JONES

C NASDAQ COMPOSITE D S & P 500

19. When the market takes a downhill turn and prices are decreasing

A Bear B No such term

C Bull D Bronco

20. Can interest rates affect the stock market?

A YES B NO

21. A corporation “goes public” when it ___________________.

A has a big party and invites all its investors. B gives out its first dividend.

C becomes an entity. D first issues stock to investors to buy.

22. As long as you are 18 years old and have some money, you can invest it in the stock market.

A True B False

23. The name for a part of a business that is bought and sold on the stock market is:

A Share B Part

C Stocker D Marker

24. Why would a company need to issue stock?

A To raise money. B To show customers that it's successful.

C To stop the government from regulating it. D To increase its' customer base.

25. How do you make money buying stocks?

A

You sell it for a higher price than you

bought it for.

B

If you hold on to it as long as possible it

will gain in value.

C

The DOW ratings determine which stocks

will pay out.

26. What does NASDAQ stand for?

A

National Application of Securities Dealers

Automatic Quotations

B

Nominal Association of Securities Dealers

Automatic Quotations

C

New Association of Securities Dealers

Automatic Quotations

D

National Association of Securities Dealers

Automatic Quotations

27. People who own stocks are guaranteed a return on the money they have invested in stocks.

A TRUE B FALSE

28. What is the name of the most well know stock exchange?

A The Louvre B The New York Stock Exchange (NYSE)

C The Boston Stock Exchange D The Imperial Stock Exchange

29.

The possibility of losing some or all of a particiular investment.

A profit B risk

C industry D index

30.

A stock market crash can be brought on by

A economic crisis B major catastrophic event

C collapse of a stock bubble D all of these

31. What is a bond?

A

an investment that cannot be traded

B

lending money to a company for a fixed

interest payment

C a building on wall street D a share of ownership in a company

32. Do more or fewer people invest in the stock market when interest rates go up?

A FEWER B MORE

33. A company owned by families or a small number of investors and do not issue stock to the

public.

A portfolio B industry

C private company D public company

34. Not having all your stocks in one industry (airlines, food, etc) is called

A Diversifying B Directing

C Trading D Portfolio

35. Explain what an IPO is.

A

It's when a company goes 'public' and

offers its stock for sale for the first time.

B

It's when a company buys back a lot of its

stock to gain control of the company.

C

It's when another company buys a lot of

stock in another company to take it over.

36. A Neon Oil Corporation tanker spilled oil in the ocean around Australia. As a result of this

accident, the share price of this stock is likely to

A

increase

B

not be affected and remain about the

same

C fluctuate D decrease

37. How does a bear stock market impact the U.S. economy?

A

Consumers will purchase more vacation

homes.

B

Americans will invest more money in the

stock market.

C

Americans will invest less money in the

stock market.

D

Consumers will purchase more large

appliances.

38. When you own stock in a company,

A you are part owner. B you are the CEO.

C

you are entitled to a dividend.

D

you are involved in day to day

management.

39. The number of shares that have been traded in the current or most recent trading session is

called

A Previous Close B Dividend

C

Last

Last

D

Volume

40. The highest price the stock has traded over the past year is called

A

Market Cap

Market Cap

B

Day High

C 52 Week High D Beta

Answer Key

1. 2. d 3. b 4. b

5. c 6. c 7. a 8. d

9. a 10. c 11. b 12. b

13. a 14. a 15. c 16. d

17. c 18. a 19. a 20. a

21. d 22. a 23. a 24. a

25. a 26. d 27. b 28. b

29. b 30. d 31. b 32. a

33. c 34. a 35. a 36. d

37. c 38. a 39. d 40. c

Introduction to the Stock Market

48 Questions

NAME :

DATE :

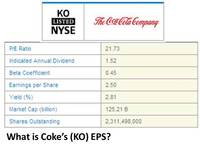

1. EPS x (times) Shares Outstanding = a company's total ________

A Profits B Sales

C Dividends D Market Capitalization

2. In a 2-for-1 stock split, the price of the stock is

A doubles B falling

C cut in half D not affected

3. What is a bond?

A a building on wall street

B lending money to a company for a fixed interest payment

C an investment that cannot be traded

D a share of ownership in a company

4. A dividend is a portion of the company's profits paid to its shareholders.

A True B False

5. What is an IPO?

A when a company first sells stock to the public

B a new Apple product

C when the company's shareholders have a meeting

D when the government creates shares on the stock exchange

6. For a company to exist for the long term what must it continue to do?

A Provide for customers B Produce a product or a service

C Make a profit D Help the economy to grow

7. interest calculated at regular intervals solely on principal

A Simple Interest B Compound Interest

8. What is a mutual fund?

A a fund that follows an index like a stock B a type of high interest bank account

C a pool of securities you can buy as an investment

D a fund used by companies to raise capital

9. The last closing price of a stock divided by the last 12 months earning per share is

A Dividend Yield B Debt to Asset Ratio

C Earnings /Share D P/E

10. The price paid for the first share of stock in a trading session is

A Last B Bid

C Open D Change

11. Mutual funds are:

A usually less risky than investing in a money market

B an investment that holds a wide range of different investment instruments, providing diversification

C guaranteed to increase in value

D an investment portfolio managed by the investor

12.

A $13.31 B $1.24

C $1.95 D $0.90

13. Which of the following is your right as a shareholder of common stock?

A the right to dividends if paid B the right to hire officers of the corporation

14. What are 2 ways you can make money in stock market

A Use all of your money to buy stocks

B Do research and invest in stocks that do well

C be aware somebody will make you do that D Buy what everyone else is buying

15. If a company issues dividends, preferred stock holders are paid the dividends first.

A True B False

16. Typically, stocks are a good invest for the average person over a long period of time.

A True B False

17. A _____ is a list of the securities, including stocks, mutual funds, and cash that you own.

A folder B notebook

C collection D Portfolio

18. What does EPS stand for?

A Earnings People's Share B Earnings Per Share

C Earnings Price Share D Earnings Profit Share

19. In short selling, you first ___ the stock.

A buy B split

C hold D sell

20. _____ stock is the name applied to the stock of large, well-known, well-established companies

with good reputations.

A Dip and chip B Paint chip

C Chocolate chip D Blue chip

21. What is a another word for earnings?

A Dividends B Profits

C Stocks D Shares

22. What is Capitol gain?

A The gain of money a Capitol city gets B Short selling

C The amount a company gets that year D The increase in the value of the stock

23. What is the goal of an investor?

A Buy low and sell high B Keep a stock for their entire life

C Open a new investment account D Help a company get bigger

24. What is the Bull market

A When the stock market trends downward B This is when the bull owns the market

C The place where you buy bulls for bull fights

D When the stock market trends upward

25. Publicly held corporations

A are listed first on the New York Stock Exchange

B guarantee a positive return to investors

C are not-for-profit organizations

D have shares of stock that are held by public (outside) investors

26. Why should an investor diversify?

A promises growth in your investments B lets customers spend more

C gives a company more options D spreads the risk taken by a shareholder

27. Dividends

A The money a company makes each year

B The part of the corporations profit paid to stockholders

C How much money the owner makes

D The answer could be any one of these have fun

28. What is the primary reason why companies issue stocks?

A To ensure a stable market B To raise extra money for the company

C To guarantee the success of a new product

D To provide for their employee's retirements

29.

A $ 0.62 B $ 2.50

C $ 1.95 D $ 0.55

30. What is Leverage?

A The average growth of a stock each year B A rise in the general level of prices

C Prying open a door with a crowbar

D The use of borrowed money to buy securities

31. What is a Bear Market?

A when the stock market trends upward B answer the question see if you are correct

C When the stock market trends Downward D A place where you sell bears downtown

32. Yield of the stock based on last price. Figured by dividing the yearly dividend by the last price.

A Change B Dividend

C Dividend Yield D Previous Close

33. What is Common Stock

A Stock that the common people buy B leaves of corn that look alike

C variable dividend but no voting rights

D A type of stock that pays a variable dividend. Gives holder voting rights

34. What are preferred stocks

A Stocks that most people prefer

B A type of stock that pays a fixed dividend and carries no voting rights

C Stocks that make millions

35. People who invest in the stock market will automatically make money.

A False B True

36. What are stock shares?

A Certificate showing a company's income

B Certificate showing a company's retirement system

C Certificate showing a company's dividends

D Certificate showing partial ownership of a company

37. Shares Outstanding x Last Trade = _________

A Sales B Profits

C Market Capitalization D Earnings

38. Common stock is more prone to rapid changes; therefore, there is more risk associated.

A True B False

39. Publicly held corporations

A are not-for-profit organizations

B have shares of stock that are held by public (outside) investors

C are listed first on the New York Stock Exchange

D guarantee a positive return to investors

40. What does a stock represent?

A a contract for a company's goods and services

B a percentage of ownership of a company

C a loan you make to a company D stocks are just tools used to make money

41. What is NASDAQ?

A Certificates certifying you own a stock

B What stocks are called when they are bought and sold

C The biggest stock market in the world D An automated system for trading stocks

42. How do people make money investing in bonds?

A Selling a bond for more than you paid B Give them $100

C Take the money from the bond people D James Bond

43. The NYSE is an exchange where daily auctions (the biding of stocks) determine the price for thousands of different stocks.

A False B True

44.

What is a stock?

A A person who buys things for you

B A document that represents ownership in a company

C A document that states you are worth a lot of money

D A part of a share of showing profit in a company

45.

Does Home Depot pay a dividend? See quote behind the questions.

A Yes B No

46. If a bond is held to maturity, the investor will receive an amount stated on the bond known

as the _______.

A face value B maturation value

C printed value D ticket value

47. Stocks are a share of ownership in a company and a person who owns one or more shares of stock is called a ...

A Broker B Dividend

C Securities D Stock Holder

48.

National Association of Securities Dealers Automated Quotations, or NASDAQ,

A uses stockbrokers in conjunction with the Dow to make trades

B uses a computer automated system for trading

C uses ebay to help make the trades D uses the same trading system as the NYSE.

Answer Key

1. a 2. c 3. b 4. a

5. a 6. c 7. a 8. c

9. d 10. c 11. b 12. d

13. a 14. b 15. a 16. a

17. d 18. b 19. d 20. d

21. b 22. d 23. a 24. d

25. d 26. d 27. b 28. b

29. b 30. d 31. c 32. c

33. d 34. b 35. a 36. d

37. c 38. a 39. b 40. b

41. d 42. a 43. b 44. b

45. a 46. a 47. d 48. b

Post a Comment for "STOCK MARKET PART 7"